Cfd trading malaysia

In a trading community of millions of users, you can really feel when the sentiment changes. Follow the real-time moves of traders from over 100 countries and join the conversation as they discuss their strategies Versus Trade.

Plus500 does not charge fees on deposits, real-time quotes, or rolling positions, and it doesn’t charge commissions on opening or closing trades. Its only fees are on spreads, overnight financing, currency conversions, and inactivity.

Before starting his career as a writer, Kane studied at the University of Central Lancashire where he received a Masters Degree in Financial Investigation and then a Research Doctorate in Criminal Justice. Pepi is passionate about helping people to make informed decisions through high-quality, educational content.

Saxo’s flagship suite of platforms for trading CFDs is my pick for the best CFD trading platform in 2025. Including SaxoTraderGO for web and mobile and SaxoTraderPRO for desktop, Saxo’s popular platform suite is loaded with trading tools, powerful charting, and cutting-edge research. In my review of Saxo, I describe its suite of platforms as having a “near-perfect balance of ease of use and advanced features.” Whether you use web or mobile with GO or you decide to stick to desktop with PRO, Saxo provides an altogether excellent CFD trading experience.

Cfd trading platform

IG is also compatible with MT4. If you want to get started with IG today, you can open an account in minutes. You will, however, need to meet a minimum deposit of $250 before you can start trading. With that said, IG also offers a demo account feature that does not require a deposit. Supported payment methods include debit/credit cards and bank transfers.

On the contrary, the platform also offers CFD markets on stocks, indices, cryptocurrencies, bonds, interest rates, commodities, indices, and more. Once again, these markets not only cover major exchanges – but the emerging economies too. In terms of supported platforms, IG offers its own native web trading facility that can be accessed online or via the mobile app.

With that said, if you’re keen to trade with real money – Trading 212 allows you to get started with a minimum deposit of just $1. This is an inconsequential amount to trade – making it perfect for those of you that want to learn the ropes of CFD instruments bit-by-bit.

Why We Picked It: Plus500 offers free deposits and withdrawals, with a low $100 minimum investment requirement. A 0.7% currency conversion fee applies per transaction if the account currency differs from the traded currency. However, the platform may not be suitable for beginners, as it earns revenue exclusively from spreads rather than commissions. Experienced traders can start immediately, utilizing the platform to grow their portfolios and maximize returns. With its intuitive interface and extensive resources, Plus500 empowers investors to build multi-asset portfolios designed for long-term savings, income generation, or a balanced strategy.

Beware of using excessive leverage, even if it is tempting. It’s an enthralling feeling to control a large position in the market. But when markets are moving fast, and you are holding a highly leveraged position, there is a very high risk of losing money. Accounts can get wiped out in seconds.

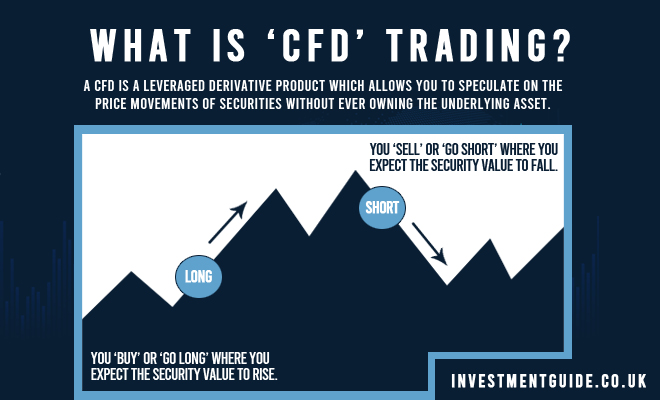

Cfd trading meaning

Cryptocurrency CFDs allow traders to speculate on the price movements of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency CFDs offer traders the ability to trade the volatile crypto markets with leverage, without having to own the underlying asset.

When holding long positions overnight, traders typically pay financing charges. These fees represent the cost of the leverage provided by the broker—essentially, the interest on the “borrowed” capital used to control a larger position. The calculation usually follows this formula:

CFDs trade over-the-counter (OTC) through a network of brokers that organize the market demand and supply for CFDs and make prices accordingly. They’re not traded on major exchanges such as the New York Stock Exchange (NYSE). The CFD is a tradable contract between a client and their broker. They’re exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

CFDs are allowed in several countries with listed OTC markets. They include Belgium, Canada, Denmark, France, Germany, Italy, the Netherlands, New Zealand, Norway, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, and the United Kingdom.

Cryptocurrency CFDs allow traders to speculate on the price movements of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency CFDs offer traders the ability to trade the volatile crypto markets with leverage, without having to own the underlying asset.

When holding long positions overnight, traders typically pay financing charges. These fees represent the cost of the leverage provided by the broker—essentially, the interest on the “borrowed” capital used to control a larger position. The calculation usually follows this formula:

Cfd trading platforms

“FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools.”

We preferred brokers with a broad range of CFD instruments and diverse account types suitable for various trader levels. Customer support responsiveness, deposit and withdrawal convenience, and offered leverage were also key considerations.

The beauty of CFD platforms is that they often give you access to thousands of financial markets. After all, CFDs are only tasked with tracking the price movements of the asset in real-time – meaning there is no requirement or need for you to own the instrument.

Ultimately, this allows you to try the platform out before making a financial commitment. In addition to the trading experience itself, the best CFD platforms should make the process of depositing and withdrawing funds a simple one.

The platform has received excellent reviews on TrustPilot and currently has over 60,000 users in 100+ countries. Axi places a strong focus on customer satisfaction, offering 24/5 customer support as well as a friendly user interface.